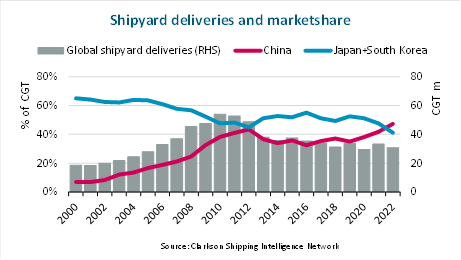

According to the new data released by BIMCO, the market share of Chinese shipyards will reach 47% in 2022, surpassing the total market share of Japanese and Korean shipyards for the first time, according to Sam Chambers, a reporter of foreign maritime websites.

In 2022, the total number of ships delivered by Chinese shipyards to new shipowners was 14.6 million tons, while 14.6 million tons of the 30.8 million total compensation tons delivered globally. The other two major shipbuilding countries, Japan and South Korea, delivered 4.8 million tons and 7.8 million tons respectively.

In the next few years, Chinese shipyards will also lead the delivery of ship orders. At present, the global total order volume is 109.1 million cubic feet, 45% of which are held by Chinese shipyards, while Korean shipyards and Japanese shipyards hold 34% and 10% of the orders respectively.

Twenty years ago, the market share of Chinese shipyards was less than 10%, but the large-scale capacity expansion in the 2000s pushed China to the top in 2009 and compete with South Korea in the next few years.

Niels Rasmussen, chief shipping analyst of BIMCO, said that shipyards in other countries are unlikely to become competitors of China, South Korea and Japan in the short term, and they may retain nearly 90% of the market share.

Rasmussen said: "Vietnam and the Philippines and other countries may become bigger competitors in the future to seek lower costs; this is in line with the historical shift of shipbuilding centers from Europe to Japan, then to Korea and China." Similar. ".

Compared with the boom in the 2000s, the number of shipyards has been significantly reduced, and the industry is now more risk-averse after years of losses.

According to Clarksons Research, today's shipbuilding capacity is about 40% lower than ten years ago. At present, there are only 131 large shipyards, down from 321 during the shipyard boom in 2009. The monitoring of individual facilities by Clarkson Institute shows that in the medium term, capacity will only increase moderately or marginally. The forward order coverage of shipyards has risen slightly from 2.5 years in 2020 to 3.5 years, and the price in 2022 will rise by 5%, but the average price in 2022 will be 15% higher than that in 2021.

In the past few months, Splash has reported the reopening of the closed Chinese shipyard, STX Dalian Shipyard and Rongsheng Shipyard, as well as the reopening of Hyundai Heavy Industries' shipyard in Kunshan, South Korea. At the same time, 20 billion yuan (total) of US $2.9 billion has been started in Northeast China and will be completed by the end of 2024. The new shipyard will be operated by DSIC and will focus on the construction of LNG carriers.

Norwegian agent Fearnley has also been checking the condition of the site. In a speech last month, Dag Kilen, director of global research at Fearnley, pointed out that Japan is currently the only Asian shipbuilding power with relatively early delivery time.

With the development of ten years, Keelen predicts that shipbuilding bottleneck will emerge, which will become the west slope of all shipping industries.

Not everyone believes in this potential crisis. Danish Ship Finance believes that further integration is imperative because up to 30% of existing shipyards may soon lose orders.

Danish Ship Finance said in a recent report: "The imbalance of orders has led to the underutilization of many shipyards that do not build containers or LNG carriers. Many shipyards have not received ships delivered under new orders. According to the data of Danish Ship Finance, 95 first-tier shipyards will use 70% of their capacity in 2022. Danish Ship Finance predicts that more second-tier shipyards will use only 70% of their capacity in 2022. 40% of the capacity, less of the capacity will be used in 2023, and It is predicted that if the shipyards with insufficient orders close one year after the last delivery, the global shipyard production will be reduced by 9 million tons, or 18%, by the end of 2024.