China Ocean Shipping Group is the world's fourth largest container transportation line operator, with an 11% market share.

The performance of COSCO has shown a sharp and continuous decline from last year until now. Taiwan Airlines' early revenue reports for the first two months of this year showed that the first quarter may have decreased by 40% or even more compared to the fourth quarter of 2022.

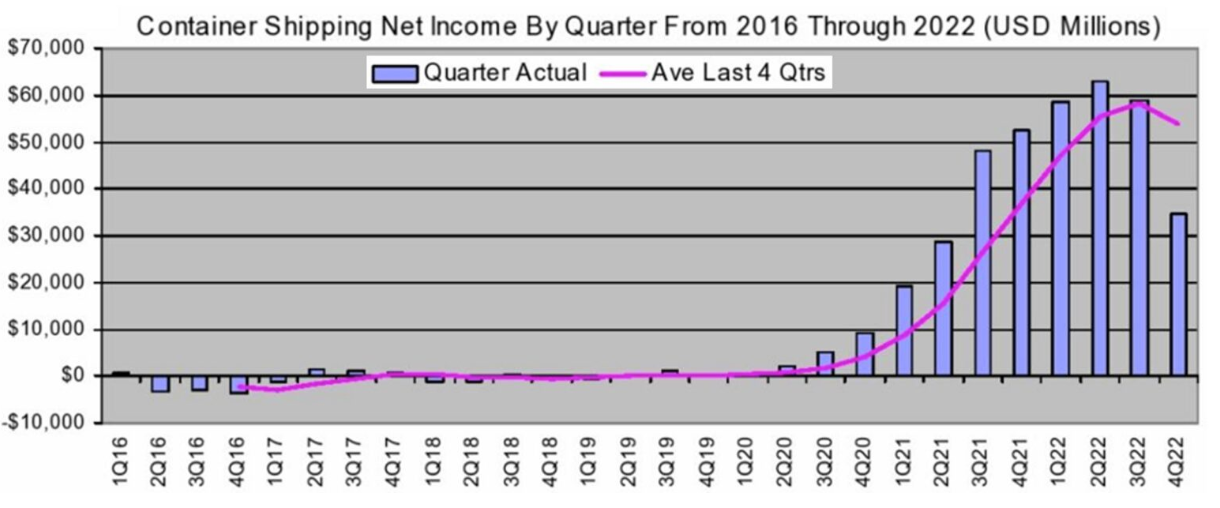

After COSCO released its results, independent analyst John McCown released his overview of last year's container transportation profits and his forecast for this year.

According to McCown's data, the total net revenue of container shipping companies in 2022 reached $215.3 billion, which is astonishing. The total profit for the fourth quarter of 2022 was $34.7 billion, a year-on-year decrease of 34% and a decrease of 41% compared to the third quarter.

McCown predicts that the revenue of shipping companies will reach $43.2 billion in 2023, a year-on-year decrease of 80%. He believes that in the first quarter of 2023, the industry's net revenue will drop to $14.9 billion, a continuous decrease of 57% compared to the fourth quarter. He estimates that net income will decrease to $10.8 billion in the second quarter of 2023, and to $8.7 billion in the third and fourth quarters.

Vespucci Maritime CEO Lars Jensen called McCown's forecast for 2023 "an optimistic one".

Prior to the announcement of COSCO's results, Sea Intelligence estimated that the industry wide pre interest and tax profit would reach $208 billion in 2022, compared to $164 billion in 2021 and $24 billion in 2022.

Although it is difficult to estimate the pre interest and tax profits of historical industries, according to our best estimate, the operating profits of airlines in the past three years since the maiden voyage of the first container ship are much higher than the total of the previous 63 years, "said Ocean Intelligence.

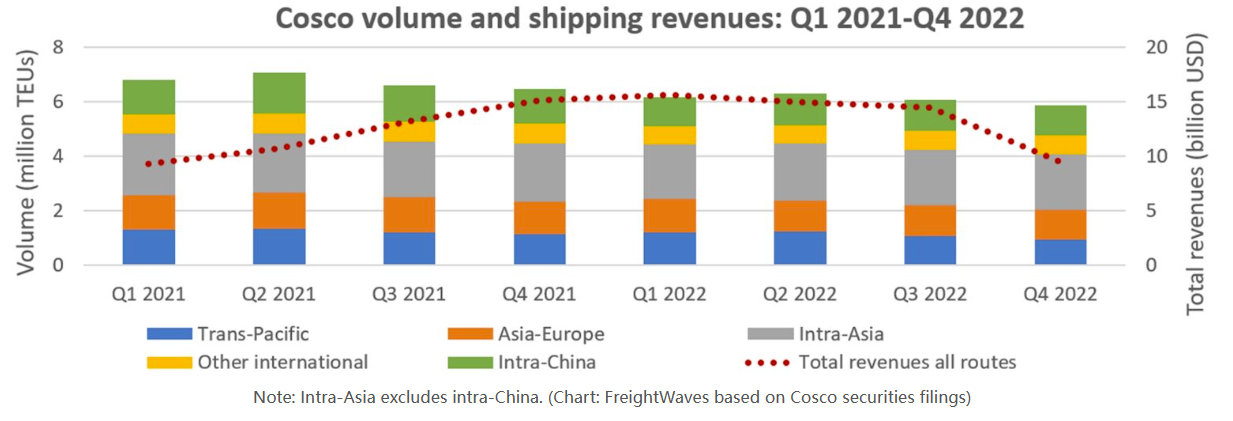

Specifically, COSCO's liner business (excluding the terminal department) showed that the group's container transportation department had a net income of $20.32 billion for the entire year of 2022, a year-on-year increase of 22%.

However, this growth was severely affected towards the beginning of the year.

The shipping department (including liner companies COSCO and Dongfang Overseas) reported net revenue of $2.68 billion in the fourth quarter of 2022, a year-on-year decrease of 37% and a decrease of 53% compared to the third quarter.

COSCO's quarterly net shipping revenue reached a cyclical peak of $6.76 billion in the second quarter of 2022, more than double its recent profit.

COSCO's shipping revenue peaked in the first quarter of 2022, reaching $15.62 billion. By the fourth quarter, shipping revenue had dropped to $9.47 billion, a 39% decrease from the high point.

The volume of container transportation has also decreased, especially in Western trade. In the fourth quarter of 2022, COSCO's liner company transported 5877589 20 foot equivalent liners globally, a year-on-year decrease of 9%. The cross Pacific transportation volume of its liner companies decreased by 15.5% year-on-year, with a decrease of 12% in the Asia Europe region. The company's highest selling market, the internal market in Asia, saw a year-on-year decrease of only 3% in sales.

COSCO's revenue per 40 foot equivalent reached a global peak of $5072 per FEU in the first quarter of 2022. As of the fourth quarter of 2022, revenue per FEU decreased to $3223, a 36% decrease from its high level.

In the fourth quarter of 2022, the revenue per FEU decreased by 31% year-on-year, a continuous decrease of 32% compared to the third quarter. The largest consecutive decline occurred in the Trans Pacific region, with COSCO's revenue per FEU decreasing by 41% quarter on quarter.

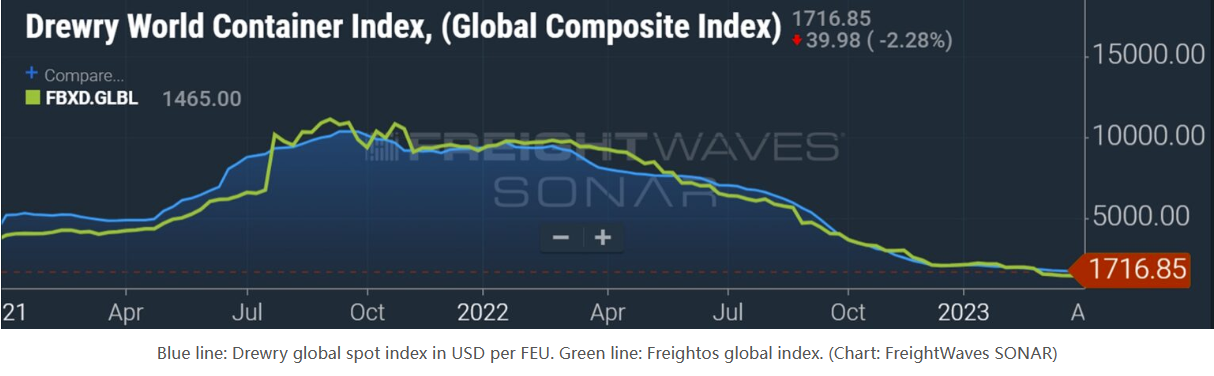

The revenue data of each FEU of COSCO Group once again highlights the limitations of the spot container freight index.

The spot index is good at displaying the future direction of the entire market, rather than the actual revenue of each FEU of the operator. There is almost no similarity between the global revenue curve per FEU of China Ocean Shipping Company and the global spot index curve. The spot index fell earlier and the decline was even greater.

Most of COSCO's trading volume is in mainland China and mainland Asia markets, which are not within the global index range. In addition, most of the transportation volume on the lanes covered by the index is based on annual contracts, and the annual contract rates for the past year have significantly exceeded the spot rates.